By Gubad Ibadoghlu, Senior policy analyst of Economic Research Center

The worldwide coronavirus pandemic continues to damage Azerbaijan at the national level and the global economy and integration at the international level. The fight against the virus has resulted in a decrease in state revenues on the one hand, and an increase in state expenditures on the other. The negative impact of both trends is creating serious financial difficulties in a number of countries. That is why the International Monetary Fund (IMF) has announced that it is increasing financial assistance to developing countries to 1 trillion USD[1]. The IMF estimates that developing countries will need to spend 2.5 trillion USD to respond to the coronavirus[2]. The vast financial resources of developed countries and the availability of special funds allow them to respond to the coronavirus without the help of international financial institutions. Many of these countries are preparing for an economic crisis, stepping up the response to the coronavirus and expanding aid packages for affected people and businesses. The main purpose of these programs is to maintain a balance between aggregate demand and aggregate supply in times of crisis, and to create a defense system against the effects of the crisis.

The response to the coronavirus in Azerbaijan has been carried out without the support of international financial institutions. On March 19, 2020, following discussions within the government, the president signed Presidential Decree № 1950 On a number of measures to reduce the negative impact of the coronavirus (COVID-19) pandemic and, consequently, sharp fluctuations in world energy and stock markets, on the economy, macroeconomic stability, employment, and businesses in the Republic of Azerbaijan (hereafter the decree). In accordance with the decree, 1 billion AZN was allocated to the Cabinet of Ministers from the 2020 state budget to finance measures in this area. In addition, the Coronavirus Response Fund was established by the March 19, 2020 Order of the President of the Republic of Azerbaijan On measures to protect the health of the population and strengthen the response to the coronavirus infection in the Republic of Azerbaijan (hereafter the order)[3].

As of November 1, 2020, the Fund had received 113,769,304 AZN, of which 20 million AZN was allocated from the President’s Reserve Fund[4], and of the remaining funds 86,378,932 AZN came from donations from legal entities, and 7,373,694 AZN came from individuals[5]. In addition, the European Union provided 14 million EUR to Azerbaijan for the purchase of necessary medical supplies[6]. Georgia received 183 million EUR in aid, Belarus 60 million EUR, Moldova 87 million EUR, Ukraine 190 million EUR, Armenia 92 million EUR, and Azerbaijan 14 million EUR.

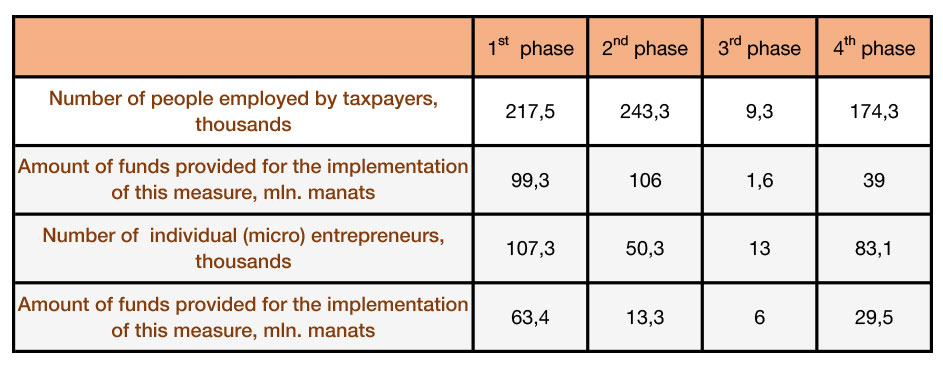

Eight days after the World Health Organization declared the COVID-19 virus a global pandemic, on March 19, 2020, President Ilham Aliyev signed a decree allocating 1.409 billion AZN from the 2020 state budget to the Cabinet of Ministers to finance measures to reduce the negative impact of coronavirus on the economy[7]. Of those funds, 752 million AZN was spent over 6 months. Minister of Finance Samir Sharifov stated that, “149 million AZN had been spent out of 250 million AZN allocated for health care, as had 281 million AZN out of 570 million AZN for socio-economic support measures, 244 million AZN out of 309 million AZN for social security support measures, and 180 million AZN out of 280 million AZN for financial support to state companies[8].” The payment of a part of the salaries of employees working in sectors affected by the pandemic and support to entrepreneurs was carried out in two stages. In Table 1, information is given on both phases of the financial support provided by the Ministry of the Economy as of September 28 to entrepreneurs affected by the coronavirus pandemic to pay part of the salaries of employees in accordance with the Action Plan approved by the Cabinet of Ministers on the implementation of clause 10.2 of the decree[9].

Table 1. Direct financial support to taxpayers

In addition, in accordance with the Action Plan of the Cabinet of Ministers, along with direct financial support, the Ministry of the Economy has introduced a temporary tax regime due to significant changes in economic conditions as a result of the spread of the coronavirus pandemic.[10] The term of these benefits was set for one year from January 1, 2020. In addition, for those working in sectors affected by the coronavirus pandemic and subject to the temporary tax regime: 1. From January 1, 2020, a number of tax benefits are established for taxpayers for a period of one year. These exemptions apply depending on the method of taxation chosen by the taxpayer. Tax exemptions in the amount of 75% of profit (income) were provided to taxpayers operating under the profit (income) tax regime. 2. A 50% discount on the amount of simplified tax shall be applied to simplified taxpayers engaged in food service and passenger transportation. The tax rate in the food service sector has been reduced from 8% to 4%. 3. The tax rate at the source of payment for the lease of real estate from individuals has been reduced from 14% to 7%. It is planned to establish a number of tax holidays for the submission of tax returns and reports, as well as for the carrying out of tax payments in the sectors of economic activity affected by the coronavirus pandemic and operating under the temporary tax regime. These benefits include: 1. Exemption from current tax payments and from the issuance of certificates related to current tax payments for a period of 1 year. Extension of the deadline for payment of the last tax for 2019 until September 1, 2020;

Extension of the deadline for payment of accrued profit (income) and property taxes by taxpayers who are not micro-business entities until September 1 of the current year; 3. Postponement of the calculation of interest on unpaid taxes, compulsory state social insurance, and unemployment insurance premiums from April 1, 2020 to January 1, 2021; 4. Extension of the right to choose the simplified tax method for 2020 by persons engaged in food service and registered for VAT from April 20 to September 1. Finally, it should be noted that the following benefits apply to micro-entrepreneurs who are simplified taxpayers, regardless of whether they are affected by the coronavirus pandemic:

1. 50% discount on simplified tax (tax rate reduced from 2% to 1%);

2. Submission of simplified tax reports, reports on profit (income), and property taxes for the first and second quarters of 2020, and granting a tax holiday for the payment of the assessed tax until September 1 of the current year;

3. By the decision of the Cabinet of Ministers, the period of full or partial restriction of relevant activities shall not be included in the validity period of receipts received by individual taxpayers engaged in obtaining fixed receipts and the taxes paid shall be included in subsequent payments.

Summing up the first stage of the socio-economic policy of the Azerbaijani government with regard to the pandemic, we can draw attention to the following important lessons and make predictions. The government’s early opening of the economy further increased the costs of business and the population. Costs doubled for cafes, restaurants, and large shops operating for a short time and specializing in the sale of non-food products. Although such businesses were partially compensated by the state when they were first closed, they were not given any economic support the next time they were closed. If this continues, businesses in increasingly difficult financial circumstances will likely be forced to cut some jobs, especially to reduce fixed costs. This will lead to a second and more massive wave of unemployment. Agriculture did not benefit from the government’s economic stimulus package because it was not included in the list of economic sectors affected by the pandemic. In fact, during the special quarantine period, restrictions on movement between agricultural regions and Baku, as well as foreign countries (e.g. Russia, the main export market for agricultural products) hindered the sale of agricultural products. For example, during the special quarantine regime, when agricultural products could be transported to Baku only by truck, households who normally transported their produce in their own cars were placed in a desperate situation. Restrictions on Russia’s borders with Azerbaijan, as well as on Russian markets, have made it difficult for agricultural exporters to sell their goods and have broken the value chain. The failure to establish an insurance system for agricultural producers suggests that the damage will not be compensated. As agriculture is the main raw material base of the food industry, the damage caused by the pandemic, especially to family farms, will create food supply problems in the future. On the other hand, given that half of the country’s population lives in rural areas and agricultural producers are mainly family farms, the loss of most of them will deepen poverty and unemployment in agricultural areas. Therefore, we offer the following proposals:

1) Register agricultural producers and take an inventory of available fixed assets.

2) Establish an insurance system for agricultural producers.

3) Create a loan guarantee fund for agricultural producers.

4) Increase agricultural producers’ access to soft and long-term loans through the loan guarantee fund.

During the pandemic, the 190 AZN one-time assistance for the social protection of low income families failed to establish an adequate social protection system to compensate the poor and the unemployed.

First of all, the restrictive norms applied to its allocation deprived many people of the assistance. Second, recipients were not differentiated according to the number of family members they represented. Regardless of the number of family members, only one of them could be recognized as entitled to assistance. This is not an effective social protection system for large families.

Despite the different social needs of the regions, the social protection system during the pandemic was not differentiated by region. At the same time, prior to the pandemic, important indicators such as the number of unemployed and poor in the regions, or the health infrastructure, were not taken into account. In particular, no distinction was made between Baku and the regions. According to the latest World Bank estimates, the poverty rate in Baku is 16%, while in agrarian regions it is 24%[11]. In short, a generalized approach was taken. However, a differentiated approach would be more effective.

During the pandemic, the business package to support entrepreneurship has played an important role. The state provided financial assistance to tens of thousands of businesses and hundreds of thousands of employees. Hundreds of entrepreneurs have been provided with soft loans under new programs. Tax breaks on real estate, land, profit, income, etc. are planned and will last until the end of the last year.

[1]“The Great Lockdown: Worst Economic Downturn Since the Great Depression”, IMF March 23, 2020, https://www.imf.org/en/News/Articles/2020/03/23/pr2098-imf-managing-director-statement-following-a-g20- ministerial-call-on-the-coronavirus-emergency

[2]Opening Remarks at a Press Briefing by Kristalina Georgieva following a Conference Call of the International Monetary and Financial Committee (IMFC), IMF March 27, 2020, https://www.imf.org/en/News/Articles/2020/03/27/sp032720-opening-remarks-at-press-briefing-following-imfcconference-call 3

[3] On a number of measures to reduce the negative impact of the coronavirus (COVID-19) pandemic and, consequently, sharp fluctuations in world energy and stock markets, on the economy, macroeconomic stability, employment, and businesses in the Republic of Azerbaijan, March 19, 2020: https://president.az/articles/36228 ; On measures to protect the health of the population and strengthen the response to the coronavirus infection in the Republic of Azerbaijan (hereafter the order, March 19, 2020: https://president.az/articles/36216 ; official site of the Coronavirus Response Fund http://covid19fund.gov.az/az/

[4] On a number of measures to reduce the negative impact of the coronavirus (COVID-19) pandemic and, consequently, sharp fluctuations in world energy and stock markets, on the economy, macroeconomic stability, employment, and businesses in the Republic of Azerbaijan, March 19, 2020: https://president.az/articles/36228 ; On measures to protect the health of the population and strengthen the response to the coronavirus infection in the Republic of Azerbaijan (hereafter the order, March 19, 2020: https://president.az/articles/36216 ; official site of the Coronavirus Response Fund http://covid19fund.gov.az/az/

[5] List of donation, http://covid19fund.gov.az/az/donation

[6] “EU allocates €14m to Azerbaijan to fight coronavirus,” Azernews, April 9, 2020: https://www.azernews.az/nation/163913.html

[7] On a number of measures to reduce the negative impact of the coronavirus (COVID-19) pandemic and, consequently, sharp fluctuations in world energy and stock markets, on the economy, macroeconomic stability, employment, and businesses in the Republic of Azerbaijan, March 19, 2020: https://president.az/articles/36228

[8] Meeting of the Cabinet of Ministers on the results of socio-economic development in the first half of 2020 and the tasks ahead: http://xalqqazeti.com/mobile/az/news/52102

[9] Economic growth and the mechanisms of state support measures for business, updated by the Ministry of the Economy on October 8, 2020: https://economy.gov.az/article/i-qtisadi-artima-ve-sahibkarlara-dovlet-desteyitedbirlerinin-mexanizmleri/30857#

[10] Mechanism of tax benefits and holidays for businesses operating in sectors affected by the pandemic (including small and medium-sized businesses), updated by the Ministry of the Economy on June 8, 2020: https://economy.gov.az/article/pandemiyadan%20zerer%20chekmish%20sahelerde%20fealiyyet%20gosteren%20sahibkarliq%20subyektlerine%20o%20cumleden%20kichik%20ve%20orta%20sahibkarliga%20vergi/30874

[11] World Bank report, “South Caucasus in Motion”, http://documents1.worldbank.org/curated/en/614351556553124178/pdf/South-Caucasus-in-Motion.pdf